Reducing red tape for charities by simplifying Deductible Gift Recipient laws

16 Mar 2023

Keeping an eye on changing regulations for charities

The beginning of 2023 has brought a fresh start to conversations about reforms to the regulation of fundraising and administration of Deductible Gift Recipient (DGR) endorsements. Justice Connect has recently made a submission to the Treasury’s consultation on DGR Registers reforms. In it, we expressed our support for the current proposal to simplify the administration of the four unique DGR categories set out in the draft legislation, acknowledging that the proposal will ensure consistency, reduce red tape, and remove inefficiencies in determining DGR endorsement.

In February of this year, the Productivity Commission also announced an inquiry into philanthropy, to investigate “the effectiveness and fairness of the deductible gift recipient framework and how it aligns with public policy objectives and the priorities of the broader community”.

Reimagining DGR endorsement laws for a more productive future for Australian philanthropy

DGR status is the special tax status granted to some not-for-profit organisations that allows donors to claim their donation as a deduction when filing their personal income tax return. It also opens up funding opportunities from grantmakers and philanthropic bodies that only give grants to DGR-endorsed organisations.

Years-long experience of Justice Connect’s Not-for-profit Law program indicates that access to DGR endorsement continues to be one of the most misunderstood and resource-intensive areas of the tax concession system for not-for-profits.

As a charity and DGR-endorsed organisation ourselves, Justice Connect understands this firsthand. And, as lawyers helping other small-medium not-for-profits, we see the follow key issues in practice every day:

-

-

- There are over 50 DGR categories, each with their own eligibility criteria. The rules for endorsement are complicated and sometimes can only be understood by reading court cases or detailed guidance from the regulators.

- For many popular DGR categories, an organisation must prove that its whole organisation fits into that category. This locks out organisations with a range of purposes and activities that don’t fit neatly into one category (for example, a charity with both social welfare and environmental purposes).

- Many small and medium organisations are not equipped to understand and navigate DGR endorsement without legal help, and as a result, many organisations miss out on opportunities for additional funding.

- Finally, the DGR categories have been created ad hoc by governments over the past 100 years. The causes that are supported by the DGR system don’t always line up with community expectations and many groups we assist are surprised when we tell them they aren’t eligible for DGR status. Some wonder why a war memorial repair fund or a fund for the provision of religious instruction in government schools can access these tax benefits, when other organisations doing important work in their communities cannot.

-

Charities are missing out on community support due to the inability to secure their DGR status

Our lawyers recently assisted one not-for-profit organisation that was struggling to understand and apply for DGR endorsement.

The Ubuntu Project is a Victorian incorporated association established to improve integration outcomes and services for African Australian communities in Melbourne. Successfully securing DGR status was the one step holding the organisation back from driving community fundraising and growing its impact.

In early 2021, Ubuntu Project got in touch with Not-for-profit Law for advice on how to be endorsed as a DGR. Nor Shanino, the Ubuntu Project CEO, reflected that “for a number of years, we were hesitant to proceed with a DGR application despite having a few donors and philanthropists that made commitments to support us if DGR status was secured. The reluctance in perusing a DGR was due to not having a clue where to begin, the resources to hire consultants or time to figure it out with an overwhelming workload during the pandemic.”

Not-for-profit Law then referred the Ubuntu Project to one of our pro bono member law firms for assistance with re-drafting the organisation’s purpose clause, and assistance with registering as a charity and being endorsed as a DGR. Describing the importance of pursuing the DGR status, Nor explained, “attaining DGR status will allow us to access support and secure resources that are critical in providing sustainability, necessary expansion to meet the needs of the communities we support.”

Our pro bono member law firm supported Ubuntu Project to update its rules and complete the applications for charity status and DGR endorsement. The Ubuntu Project “are patiently waiting to hear on our application which will allow us to do things that seemed impossible not too long ago.”

The Ubuntu Project is only one of the many small-medium organisations Justice Connect’s Not-for-profit Law team provided with assistance. In 2022 alone, we devoted 1,400 hours to delivering legal advice on how to apply for DGR status and comply with this complex area of the law.

How could the DGR system support our charities better?

For years Justice Connect has recommended that DGR endorsement be simplified and extended to all charities registered with the Australian Charities and Not-for-profits Commission (ACNC), where those charities use donated funds for purposes not solely for the advancement of religion, childcare, or primary or secondary education. This recommendation is aligned with previous government reports released over the past decade, including reports from Productivity Commission’s Contribution of the Not-for-profit Sector (2010) and the Not-for-profit Sector Tax Concession Working Group (2013).

Read our submission|

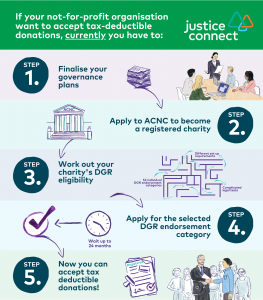

Current process of registering for Deductible Gift Recipient (DGR) endorsement:

|

Re-imagined process of registering for Deductible Gift Recipient (DGR) endorsement:

|

If the ACNC were to provide a Deductible Gift Recipient status to all registered charities, that would improve the regulatory environment for Australia’s vibrant not-for-profit sector. Providing DGR status to all registered charities would enable smaller organisations access to community support that comes when donations to their cause are tax-deductible. The increased capacity for successful fundraising will allow charities to grow their service delivery, assist their communities, and increase their impact.

We look forward to the year ahead, encouraged by the federal government’s commitment to shifting attitudes toward the philanthropic sector. Our Not-for-profit Law team continues to provide low-cost and free legal services to not-for-profit community organisations to ensure they can make sense of the law, stay legally compliant, thrive within complexity, and achieve good governance.

|

Need help with a complex query regarding your not-for-profit organisation? |

About Justice Connect’s Not-for-profit Law

Justice Connect’s Not-for-profit Law program is a national legal service, offering free and affordable legal supports for not-for-profit organisations and social enterprises. We provide timely and appropriate legal support to help community organisations make sense of the law, stay legally compliant, thrive within complexity, and achieve good governance.